Renters Insurance in and around San Francisco

Welcome, home & apartment renters of San Francisco!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through savings options and coverage options on top of family events, keeping up with friends and work, takes time. But your belongings in your rented property may need the terrific coverage that State Farm provides. So when mishaps occur, your sports equipment, clothing and mementos have protection.

Welcome, home & apartment renters of San Francisco!

Rent wisely with insurance from State Farm

Open The Door To Renters Insurance With State Farm

Renters insurance may seem like the least of your concerns, and you're wondering if having it is actually beneficial. But take a moment to think about what it would cost to replace all the valuables in your rented apartment. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your personal property.

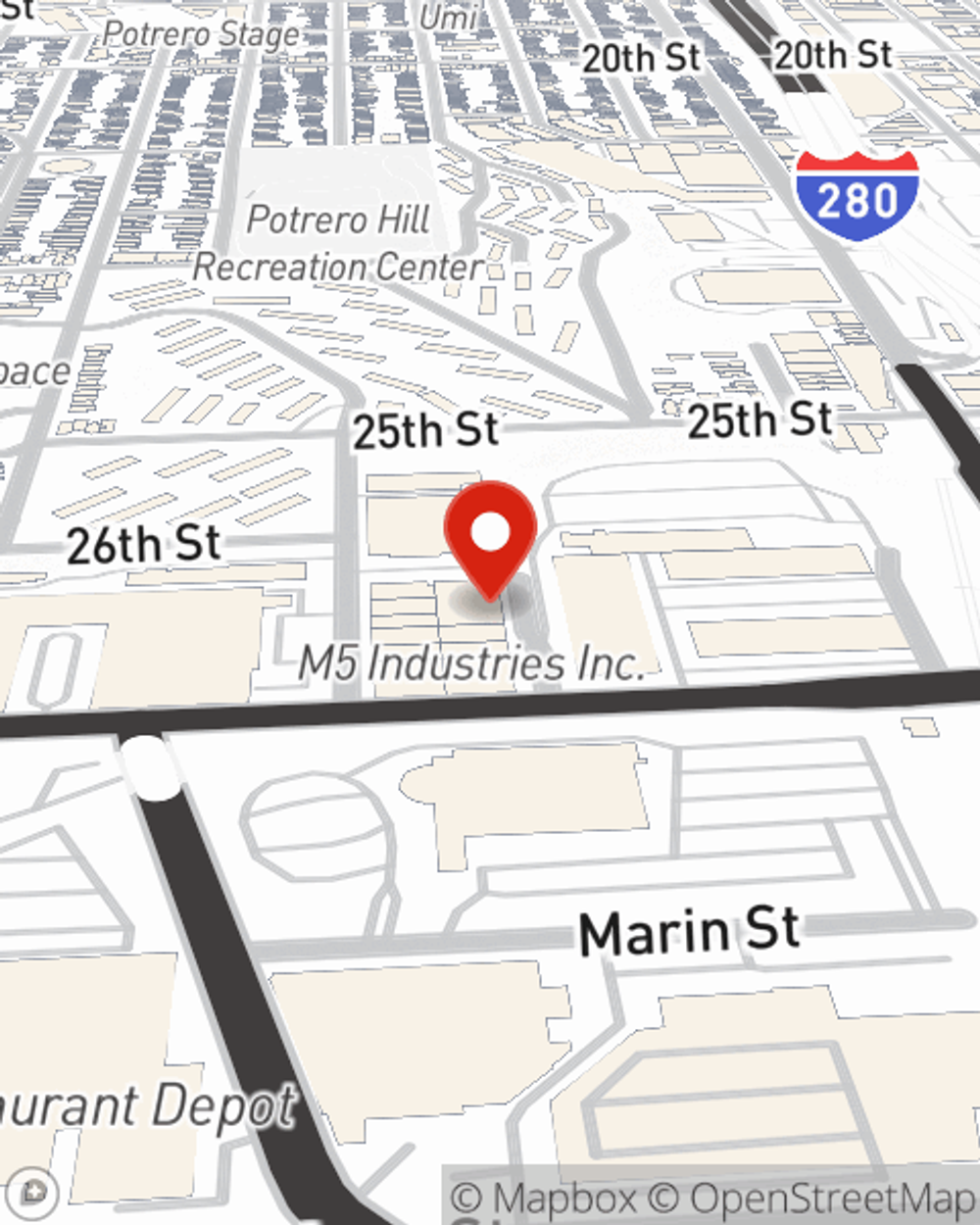

If you're looking for a committed provider that can help you understand your options, contact State Farm agent Tiffany Won today.

Have More Questions About Renters Insurance?

Call Tiffany at (415) 872-5734 or visit our FAQ page.

Simple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Tiffany Won

State Farm® Insurance AgentSimple Insights®

Moving? Don't forget to make insurance changes, too

Moving? Don't forget to make insurance changes, too

Before you move, talk with your agent about move insurance and moving your current policies. Read why transferring insurance is so important.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.