Business Insurance in and around San Francisco

Looking for small business insurance coverage?

Insure your business, intentionally

Insure The Business You've Built.

When you're a business owner, there's so much to take into account. We get it. State Farm agent Tiffany Won is a business owner, too. Let Tiffany Won help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your wages, but also helps with regular payroll expenses. You can also include liability, which is important coverage protecting your company in the event of a claim or judgment against you by a third party.

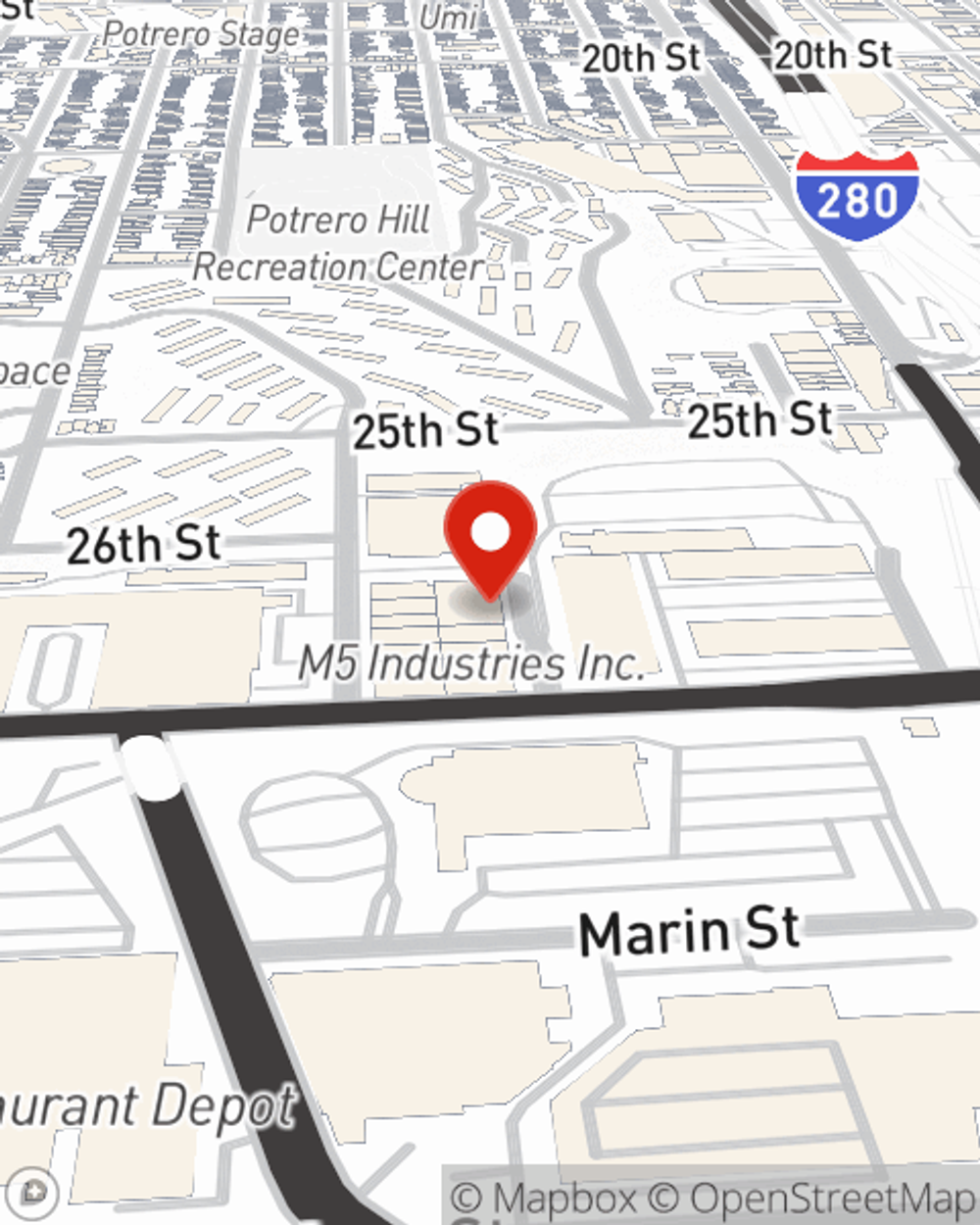

At State Farm agent Tiffany Won's office, it's our business to help insure yours. Call or email our excellent team to get started today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Tiffany Won

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.